If you’re enrolled in a high-deductible health plan at work, you may have been offered the option of an HSA. What is an HSA?

It’s a Health Savings Account. It’s designed to help you pay for health care, but it can also be a great way to plan for the future. In this article, I’ll explain the triple tax benefits that HSAs offer, how HSAs work and how you can make HSAs a part of your retirement plan.

What is a health savings account?

An HSA is a tax-advantaged savings account that you can use to pay for qualifying healthcare expenses. HSAs can help you cover out-of-pocket costs if your health insurance policy includes a high deductible. You can also invest the money you contribute to your HSA.

HSAs can be a secret weapon within your investment strategy that supplements your retirement plan. It’s a great way to pay for your medical expenses in your retirement years.

HSAs carry some exciting tax benefits that can help make April 15 a less stressful day for you.

You get an upfront tax deduction. The money grows tax-free until you use it. And then when you use the money, it’s tax-free

Do I Qualify for an HSA?

You must be enrolled in an eligible High Deductible Health Plan (HDHP) to open an HSA. HDHPs tend to feature lower monthly premiums and higher deductibles. The IRS defines an HDHP as a health insurance policy with:

- A minimum deductible.

- Maximum yearly out-of-pocket expenses.

In addition to those restrictions, you also will not qualify for an HSA if:

- You’re under 18

- Someone can claim you as a dependent on their taxes

- You’re 65+ and enrolled in Medicare

WHAT ARE THE HSA CONTRIBUTION LIMITS?

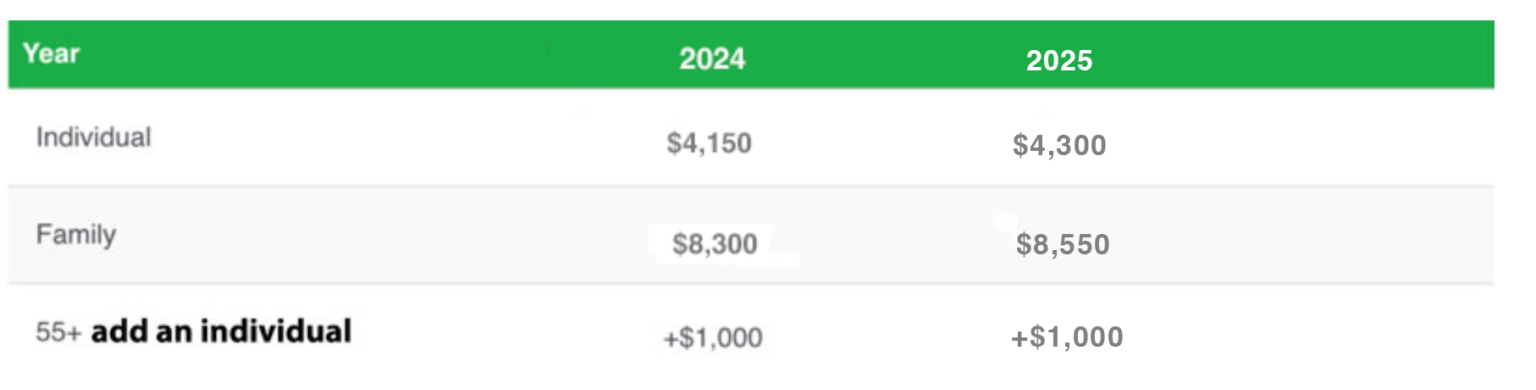

The table illustrates the maximum amounts that an individual or family can contribute to an HSA. Keep in mind that these maximums include any contributions that your employer makes. Individuals between 55 and 65 years old can contribute an additional $1,000 per year.

How Does an HSA Work?

Much like your contributions to your company 401(k) or your IRA, the funds you contribute to your HSA are pre-tax. In other words, if you make $50,000 in 2021 and contribute $2,000 to your HSA, you’ll have $48,000 in taxable income.

You can set up your HSA contributions through a payroll deduction. Or you can contribute after-tax dollars and deduct that amount from your gross income on your tax return.

You can’t use your HSA to pay for your monthly health insurance premiums. But you can use it to pay for out-of-pocket medical expenses like deductibles and co-payments.

You can use an HSA-attached debit card, or you can reimburse yourself if you paid for your medical expenses another way. You won’t have to pay any income taxes on the money you took from your HSA to make those payments.

The money in your HSA also grows tax-free. It usually earns a small amount of interest, as it’s in (as evidenced by its name) a savings account. But you can invest the funds in your HSA. And you won’t have to pay taxes on the gains as long as that money remains in your HSA.

Once you turn 65, your HSA will function somewhat like a traditional IRA. You will be able to withdraw money for any purpose. You’ll have to pay income tax on the money you use for something other than qualified medical expenses, but you won’t have to pay a penalty.

Who Should and Shouldn’t Use an HSA?

You should consider opening an HSA if you:

- Want to plan now for medical expenses in retirement. According to Fidelity, as of August 2022, the average retired couple “may need approximately $295,000 (after tax) to cover health care expenses in retirement.”

- Work for a company that offers only an HDHP for your health insurance. If you’re in an HDHP and don’t set up the HSA, you’ll have to use after-tax dollars to pay for expensive deductibles. You may also be missing out on HSA contributions from your employer.

- Enjoy good health and rarely go to the doctor. If this describes you, you may be able to save money due to the lower monthly premiums from your HDHP. (You’re not required to open an HSA when you have an HDHP, but you should.)

- Are disciplined at putting money aside. If you’re a good saver and you’ll consistently fund your HSA, it may work for you.

- Want an additional emergency fund for medical expenses. This should be in addition to your fully-funded rainy day fund.

- Are interested in the tax advantages. HSAs can help you lower your taxable income. They also give you a chance to earn interest and investment returns tax-free.

You may not want to use an HSA if you:

- Live check to check. Your budget is too tight to set aside money in an HSA.

- Need to build savings. Consider setting up a rainy day fund before you contribute to an HSA.

- Have significant ongoing medical issues. If you know you’ll incur plenty of medical expenses, you may not want the high deductibles that come with the required HDHP.

What Can I Pay for Using an HSA?

You can find a detailed breakdown of every qualified medical expense on the IRS website.

However, almost all medical and dental services, including preventive care and mental health care, are eligible. The list is expansive, as it’s designed to cover anything you need that’s medically related. Common items include:

- Annual physical exams

- Birth control

- Dental treatment

- Hospital services

- Long-term care

- Prescription medications

- X-rays

Items like vitamins, child care for healthy babies and elective cosmetic procedures are not eligible. So you can’t use HSA funds to pay for that facelift, but you can use them to pay for pretty much anything that a doctor thinks you need in order to stay healthy.

Explaining the Investment Component of an hsa

Research suggests that the average couple may need close to $300,000 to pay for medical expenses in retirement.

You can take pre-tax money, put it into an HSA, invest it, pay no taxes on your profits and then use it to pay for out-of-pocket medical expenses. So it’s an ideal long-term plan to cover medical expenses later in life.

Yet according to research from HSA investment firm Devenir, fewer than 5% of people with HSA accounts were taking advantage of the investment component as of August 2019.

Advantages of HSAs

With a Health Savings Account, you can:

- Reduce your taxable income.

- Save money on your health insurance premiums.

- Get help paying for out-of-pocket medical expenses.

- Invest for retirement in a tax-advantaged way.

- Access a company match (contributions).

- Roll over your money from year to year.

- Take the account with you when you leave your job.

Disadvantages of HSAs

You may not like the fact that HSAs may force you to:

- Contend with expensive HDHP deductibles.

- Pay income tax plus a 20% penalty if you withdraw any of the funds before you turn 65 for non-qualifying expenses.

- Pay monthly maintenance fees, transaction fees or maintain required account minimums.

Frequently Asked Questions About HSAs

Can I Withdraw Money From My HSA for Non-Medical Expenses?

Yes. However, if you’re younger than 65, you’ll have to pay a 20% penalty on top of claiming the money as income on your tax return for that year. If you’re 65 or older, your HSA funds act much like an IRA. You’ll pay federal income tax based on your tax bracket but won’t be penalized.

Remember, you can always avoid taxes completely by using your HSA funds only for qualified medical expenses.

How Did the COVID-Inspired CARES Act Impact HSAs?

The Coronavirus Aid, Relief and Economic Security (CARES) Act permanently reinstated over-the-counter medical products and menstrual care products as eligible expenses for HSA funds.

CARES also lets you pay for telehealth services before you’ve met the plan deductible. Note that, as of this writing, that provision is set to expire Dec. 31, 2021.

How Are HSAs Different From Flexible Spending Accounts (FSAs)?

HSAs are similar to Flexible Spending Accounts (FSAs) in that they both give you a way to set aside money for health expenses. However, all employees are eligible to participate in FSA plans whether or not they have health insurance. There are other differences as well:

- The IRS allows individuals to contribute up to $2,750 in pre-tax dollars to an FSA annually. That excludes any contributions that an employer makes.

- If you’re self-employed, you can contribute to an HSA if you have a qualified HDHP, but you can’t contribute to an FSA.

- You must declare your contribution amount to your FSA at the beginning of the year during open enrollment.

- You can’t take your FSA with you if you change jobs. The money in your account also does not roll over from year to year. You can’t invest it, and it doesn’t earn interest.

- Withdrawals for non-medical purchases aren’t allowed.